Introduction

Are you wondering if you can use a credit card on Zelle? Zelle is a popular peer-to-peer money transfer service that allows users to send and receive money from their bank accounts. However, the options for using a credit card on Zelle are limited.

What is Zelle, and how does it work?

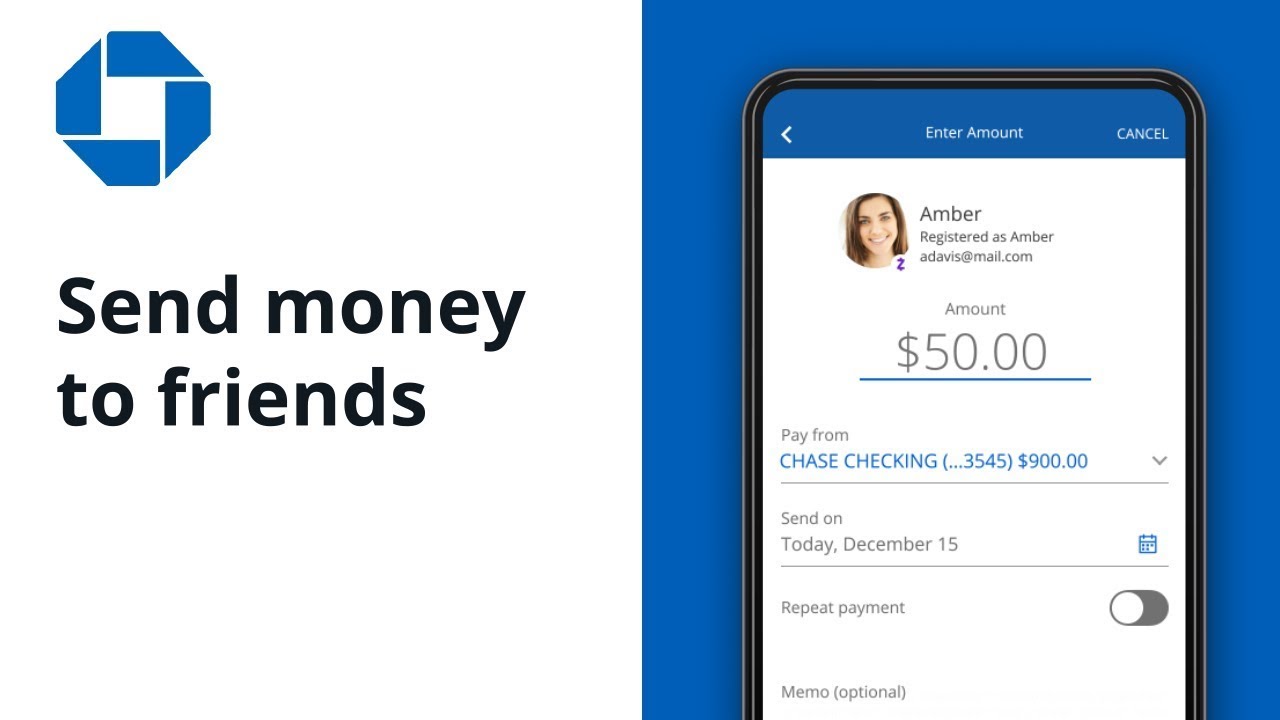

Zelle is a digital payment network that enables users to send money directly from their bank accounts to another person’s bank account. It is built into the mobile banking apps of participating banks and can also be accessed through the standalone Zelle app. To use Zelle, both the sender and the recipient need to have a U.S. bank account.

Benefits of using Zelle for money transfers

- Speed: Zelle offers near-instantaneous transfers, allowing users to send and receive money within minutes. This makes it convenient for splitting bills, paying friends, or sending money to family members.

- Security: Zelle transactions are securely encrypted and processed within the banking network, protecting your financial information.

- Ease of use: Zelle is integrated into banking apps and is easy to set up and use. You can quickly send money to anyone with a U.S. bank account using their phone number or email address.

While Zelle primarily operates through bank accounts, some banks may allow you to link a debit card to your Zelle account for transactions. However, using a credit card directly on Zelle is not a widely available option. You should check with your bank for specific details on their Zelle integration and the available payment methods.

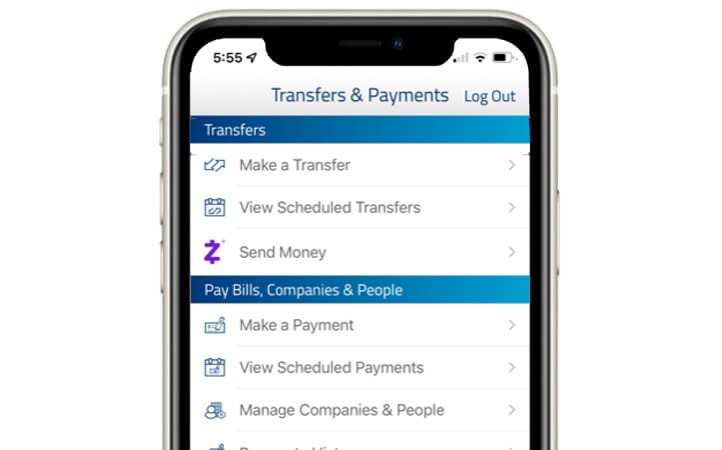

How to Set Up Zelle

If you’re looking to simplify your money transfers, Zelle is a popular option that allows you to send and receive funds quickly and securely. But can you use Zelle’s credit card?

Creating a Zelle account with your bank

To begin using Zelle, you must have a bank account that offers Zelle integration. Most major banks in the United States now support Zelle, so chances are your bank is on the list. Download your bank’s mobile app or log in to your online banking platform and follow the instructions to set up a Zelle account. It’s a straightforward process that usually involves verifying your identity and linking your bank account to Zelle.

Linking your credit card to Zelle

Unfortunately, Zelle does not currently support credit card transactions. Zelle is designed to facilitate transfers between bank accounts, making it a convenient option for sending money to friends, family, or even businesses. By linking your bank account to Zelle, you can easily send and receive funds using only your account information.

While credit card transactions are not available on Zelle, you may still be able to use your credit card indirectly through your bank’s payment options. Some banks allow you to send money from your credit card to your bank account and then transfer that money using Zelle. However, remember that additional fees or interest charges may apply when using a credit card for this purpose.

So, while you cannot use a credit card directly on Zelle, alternative methods are still available to facilitate money transfers through your bank.

Using a Credit Card on Zelle

Can you use a credit card on Zelle?

Yes, you can use a credit card on Zelle, but it is important to note that not all banks and financial institutions support this feature. Zelle primarily operates as a platform for bank-to-bank transfers, allowing users to send and receive money directly from their linked bank accounts. However, some banks offer the option to link a credit card to your Zelle account for transactions.

Benefits and limitations of using a credit card on Zelle

Using a credit card on Zelle can come with its benefits and limitations. Here are a few things to consider:

Benefits:

- Convenience: A credit card provides an added convenience layer, allowing you to make transactions without directly accessing your bank account.

- Rewards: If your credit card offers rewards such as cashback or travel points, using them on Zelle transactions may help you earn them.

Limitations:

- Fees: Some banks may charge additional fees or treat credit card transactions on Zelle as cash advances, often with higher fees and interest rates.

- Credit Limit: Remember that credit cards have spending limits, so if you are planning to transfer a large sum of money, you may need to consider any credit limits that may impact your transaction.

It is advisable to check with your specific bank or financial institution to understand their policies regarding credit card usage on Zelle and any associated fees.

Security and Fraud Prevention

Protecting your credit card information on Zelle

Zelle is a convenient way to send and receive money, but taking steps to protect your credit card information is essential. You must ensure your transactions are secure when using Zelle with a credit card. Here are some tips to help you protect your credit card information on Zelle:

- Enable Two-Factor Authentication: Set up two-factor authentication on your Zelle account. This adds an extra layer of security by requiring a unique verification code and your password.

- Use a Secure Network: Avoid using public Wi-Fi networks when transacting with Zelle. Public networks can be susceptible to hacking and data breaches. Instead, use a secure and private network.

- Regularly Monitor Your Account: Keep a close eye on your credit card statements and transaction history. If you notice any suspicious activity, report it to your credit card issuer immediately.

Tips to avoid fraud when using Zelle with a credit card

While Zelle has security measures in place, taking precautions to prevent fraud is always wise. Here are some tips to help you stay safe when using Zelle with a credit card:

- Only Send Money to Trusted Contacts: Be cautious when sending money to unfamiliar or unknown individuals. Stick to trusted contacts to minimize the risk of fraud.

- Double-Check Recipient Information: Double-check the recipient’s information before confirming a transaction. Verify the email address or phone number to ensure you’re sending money to the correct person.

- Keep Personal Information Secure: Never share your Zelle login credentials, credit card details, or other personal information with anyone. Be wary of phishing attempts or suspicious requests for information.

By following these guidelines, you can enjoy the convenience of using Zelle with your credit card while keeping your financial information secure.

Alternatives to Using a Credit Card on Zelle

Using a debit card on Zelle

If you are wondering if you can use a credit card on Zelle, the answer is no. Zelle is a digital payment service that allows you to send and receive money directly from your bank account. While Zelle does not currently support credit card payments, alternatives are available.

One alternative is to use a debit card. Unlike credit cards, debit cards are linked directly to your bank account. By linking your debit card to Zelle, you can easily send and receive money without needing a credit card.

Linking a bank account to Zelle

Another option is to link your bank account to Zelle. This allows you to transfer funds directly from your bank account to another person’s bank account using Zelle. By linking your bank account, you can easily send money without needing a credit card.

It’s important to note that Zelle only works with participating banks, so you must check if your bank is compatible with the service. Additionally, reviewing your bank’s terms and conditions is always a good idea to understand any potential fees or limitations associated with using Zelle.

In conclusion, while you cannot use a credit card on Zelle, you can still take advantage of the service by using a debit card or linking your bank account. These alternatives offer a convenient and secure way to send and receive money digitally.